Increment of Stamp Duty Rate on Residential Property Transactions in Hong Kong

On 4 November 2016, the Hong Kong SAR Government (‘the Government’) proposed a stamp duty increment. This increased the previous Scale 1 rates (i.e. ranged from 1.5% to 8.5%) on ad valorem stamp duty (‘AVD’) in respect of residential properties to a flat rate of 15%, for the purpose of combating the speculative activities in residential properties.

This increase, which was introduced with effect from 5 November 2016, was approved by the Legislative Council. In more recent times a relaxation on commercial property stamp duty has been issued.

Stamp Duty Increment Key Points

The key points under the Government’s new proposal include the following:

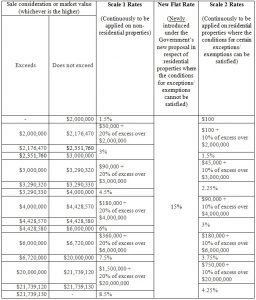

- To raise the existing Scale 1 rates of AVD on residential property transactions to a flat rate of 15%, while to maintain the existing Scale 1 rates of AVD on non-residential property transactions, such as commercial property transactions;

- To retain existing exceptions and exemptions provided for under the existing AVD regime. Amongst others, a buyer who is a Hong Kong permanent resident (‘HKPR’) acting on his/her own behalf and is not a beneficial owner of any other residential property located in Hong Kong at the time of acquisition is eligible to be subject to AVD at the existing Scale 2 rates (i.e. lower rates when compared to Scale 1 rates); and

- To maintain the existing refund regime applicable to HKPR-buyers who replace their existing single residential property by a new single residential property [i.e. Scale 2 rates (instead of Scale 1 rates) are applied].

The rates of AVD applicable after the introduction of the Government’s new proposal are summarised as follows (amount in HK$):

Comments & Insights on the Increment of Stamp Duty

- Cooling effect on overheated transactions in resident properties

The proposed increment of Scale 1 rates of AVD by the Government is due to rebound in housing price and anticipation on rising risk of a bubble in the residential property market. Prior to the Government’s new proposal, the Scale 1 rates of AVD range from 1.5% to 8.5%.

The lower the sale consideration/market value of the properties is, the lower the AVD rate will apply. The introduction of the flat rate of 15% under the Government’s new proposal potentially has larger impacts on lower-priced residential properties since the percentage increase in the AVD rates is higher than that of higher-priced residential properties.

- Being aware of the potential additional AVD payment

As mentioned above, the Government’s new proposal is subject to enactment of the relevant legislations. It is expected that the proposed measures will take retroactive effect on 5 November 2016.

Those AVD payers subject to the existing Scale 1 rates in respect of their residential property transactions conducted on or after 5 November 2016, are recommended to maintain sufficient cash for payment of the potential additional AVD calculated at the new flat rate of 15%.

- AVD refund regime in respect of change of residential property

Homebuyer (irrespective of whether he is HKPR or not) who is a beneficial owner of an existing residential property(s) in Hong Kong shall be subject to AVD at the existing Scale 1 rates (or at the flat rate of 15% after the Government’s new proposal is approved by the Legislative Council) on acquiring a new additional residential property in Hong Kong.

However, in case a HKPR acquires a new residential property (‘New Property’) to replace his/her only one original residential property (‘Original Property’) and the Original Property will be disposed within a specified statutory period, it is potentially allowed to apply for a partial refund of AVD paid for the New Property at the Scale 1 rates (or 15% flat rate when applicable), such that the HKPR in essence is only required to pay AVD at the Scale 2 rates on the New Property.

AVD Court Case

In a court case Ho Kwok Tai v. Collector of Stamp Revenue (CACV 52/2016), a dispute arises whether or not the regime of partial refund of AVD also applies to the situation where two (or more) Original Properties are replaced by one New Property by a HKPR.

The Court of Appeal held on 31 October 2016 that the AVD refund regime shall only apply to the situation where one (but not two or more) Original Property is replaced by one New Property.

With a view to avoid legal disputes, the Government proposes to enact that the above-mentioned AVD refund regime shall only apply to HKPR-buyers who have their single one (but not two or more) residential property to be replaced by one new residential property.

If you have any question about the above stamp duty increment or other taxes such as stamp duty matters, please do not hesitate to contact the experts of HKWJ Tax Law & Partners Limited.