Hong Kong 2017-2018 Budget

On 22 February 2017, the Financial Secretary of the Hong Kong Special Administrative Region (“Hong Kong”), announced the Budget for the fiscal year 2017-18. According to this Budget, the fiscal year 2016-17 is likely to have a surplus of HK$ 92.8 billion, which significantly exceeds the original estimated amount of HK$ 11 billion, largely due to higher-than-expected revenues from Hong Kong related land sales and stamp duty income.

It is forecasted that the Hong Kong fiscal reserves, as a result, will reach HK$ 935.7 billion by 31 March 2017.During the fiscal year 2016-17, Hong Kong experienced a modest economic growth of 1.9% unlike forecasted in the previous Hong Kong 2016-2017 Budget.

Nevertheless, Hong Kong is in particular susceptible to the global economic fluctuations. Therefore, its economic development for the fiscal year 2017-18 will be full of challenges and uncertainties, mainly as a result of political changes in various parts of the world. In the United States of America (“USA”) for example, the newly elected government maintains an unclear economic policy agenda, will potentially introduce trade protection measurements and expedites normalisation of its interest rates.

In addition, there are various uncertainties due to a) the exiting of the United Kingdom from the European Union, b) growth constraint in Europe due to its structural debts and c) upcoming general elections in some major European countries, such as France, Germany and the Netherlands.

Key Support & Relief Measures

Same as during prior years, the Hong Kong government continues to offer financial relief and support to both enterprises as well as individuals. The major measurements for enterprises as well as middle class and upper class individuals are the following, but please be aware that most of the above-mentioned proposals are subject to enactment of legislation before they become effective:

- Enterprises

-

- Reduction of the profits tax for the fiscal year 2016-17 by 75%, subject to a ceiling of HK$ 20,000 per case;

- Waiver of license fees for travel agents, hotels and guesthouses, restaurants, hawkers as well as fees for restricted food permits, this for the period of one year;

- Providing financial support by means of:

-

-

- Extending the application period for the so-called Dedicated Fund on Branding, Upgrading and Domestic Sales to June 2022. This Fund aims to assist Hong Kong enterprises in developing their business in Mainland China;

- Extending the application period for special concessionary measurements under the so-called SME Financing Guarantee Scheme to 28 February 2018, which assists Hong Kong SME’s with securing loans;

- Proposing to strengthen the underwriting capacity of the Hong Kong Export Credit Insurance Corporation (“ECIC”), an institution that promotes Hong Kong’s export, by raising the cap on the contingent liability of ECIC under contracts of insurance from HK$ 40 billion to HK$ 55 billion;

-

-

- Waiver of the first registration tax of electric commercial vehicles, motor cycles and motor tricycles during the fiscal year 2017-18; and

- Setting up of a HK$ 2 billion Innovation and Technology Venture Fund, which will co-invest in local innovation and technology start-ups on a matching basis.

- Individuals

- Reduction of salaries tax and tax under personal assessment for the fiscal year 2016-17 by 75%, subject to a ceiling of HK$ 20,000 per case;

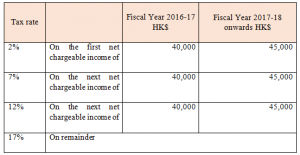

- Widening of the marginal bands for salaries tax with effect from the tax year 2017-18 as follows:

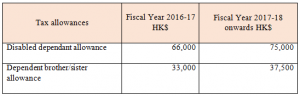

- Increment of the following tax allowances with effect from the tax year 2017-18:

- Extension of entitlement period for tax deduction of home loan interest from 15 years to 20 years, with effect from the fiscal year 2017-18; and

- Increment of the maximum tax deduction for self-education expenses from HK$ 80,000 to HK$ 100,000, with effect from the fiscal year 2017-18.

- Both enterprises and individuals

Waiver of the government rates charged on property owners for a period of four quarters during the fiscal year 2017-18, subject to a ceiling of HK$ 1,000 per quarter for each rateable property.

Other Major Tax Related Issues

(A) Implementation of the base erosion and profit shifting (‘BEPS’) package

It is mentioned in the Budget for the fiscal year 2017-18 that Hong Kong has joined the inclusive framework formulated by the Organisation for Economic Co-operation and Development in respect of implementing the BEPS package, with a view to enhance tax transparency and combat cross-border tax evasion.

(B) Broadening the network of double taxation agreement

Hong Kong has signed Comprehensive Double Taxation Agreements (‘CDTAs’) with 37 tax jurisdictions. In order to create a more business and tax-friendly environment, Hong Kong will continue to actively expand its CDTAs network with more tax jurisdictions.

(C) Extension of the profits tax exemption to onshore privately-offered open-ended fund companies

It is proposed in the Budget for the fiscal year 2017-18 to extend the profits tax exemption from offshore private equity funds to onshore privately-offered open-ended fund companies. The purposes are to attract more funds to domicile in Hong Kong and to develop Hong Kong as a global full-fledged fund service centre. The Hong Kong government will consult the industry on the legislative proposals shortly.

(D) Promotion of aircraft leasing business

As previously proposed in the Budget for the fiscal year 2016-17, the Hong Kong government is considering to offer tax concessions for aircraft leasing business, with the hope to attract more aircraft leasing companies to develop their business in Hong Kong. After having now conducted the relevant studies, the Financial Secretary of Hong Kong plans to introduce a bill into the Hong Kong Legislative Council in 2017, to amend the Hong Kong Inland Revenue Ordinance accordingly.

(E) Establishment of a tax policy unit

The Budget for the fiscal year 2017-18 proposes to establish a tax policy unit, which will be responsible for carrying out comprehensive studies on tax issues from a macro perspective. The principles/goals are that Hong Kong will (i) seek to align its tax practices with international standards; (ii) study the possible ways to foster the development of its pillar industries, including financial services, tourism, trading and logistics and professional and producer services; and (iii) explore ways to broaden its tax base and increase its tax revenue.

(F) Research into the possibility of a tax deduction for purchase of regulated health insurance products.

It is suggested in the Budget for the fiscal year 2017-18 that tax deduction for purchase of regulated health insurance products can be allowed. Relevant details are currently are being examined by the Hong Kong government.