Mainland China Beneficial Ownership

In order to improve the implementation of double tax treaties between Mainland China and other tax jurisdictions, the State Administration of Taxation of Mainland China (“SAT”) released in February 2018 a Public Notice [2018] No. 9 (“Public Notice 9”), providing further and clearer guidelines/rules in assessing the Mainland China beneficial ownership (“BO”) status for the purpose of enjoying certain tax treaty benefits by taxpayers. Public Notice 9 took effect from 1 April 2018.

Amendments of unfavourable factors in determining the BO status

Whether or not a BO status is present is mainly relevant for the dividend, interest and royalty clauses of double tax treaties as those clauses determine the relevant withholding tax rates for dividends, interests and royalties. Therefore, the SAT has issued several notices for the past few years which stated, amongst others, some unfavourable factors (“Unfavourable Factors”) for taxpayers to be a beneficial owner under the context of the double tax treaties.

In particular: (“Circular 601”), which was a notice regarding the interpretation and identification/ascertainment of the term BO under tax treaties and (“Announcement 30”), which was an additional announcement regarding the identification/ascertainment of BO within tax treaties. Please note that both Circular 601 and Announcement 30 have been repealed as a result of introduction of Public Notice 9.

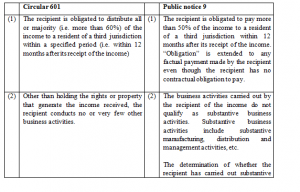

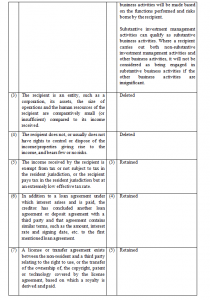

Public Notice 9 makes some amendments to the unfavourable factors stated in Circular 601 by further tightening certain Unfavourable Factors and by deleting some unfavourable Factors. The details are shown in the below table:

Unfavourable Factors of Determining the Mainland China Beneficial Ownership Status

Expansion of the Scope on the “Safe Harbour” Rule

The “safe harbour” rule was stipulated in Announcement 30. Whenever the so-called “safe harbour” rule is satisfied, an applicant for benefits/reduced withholding tax rates under double tax treaties (the “Applicant”) will automatically be deemed to be a beneficial owner (i.e. no need to further consider whether any unfavourable Factors exist).

Under the Announcement 30, the safe harbour rule only applied to an Applicant who earned dividend income from Mainland China entities. In addition, the Applicant was required to be either:

- A listed company resident in a jurisdiction with which Mainland China has double tax treaty (the “Tax Treaty Jurisdiction”); or

- A non-listed company resident in the Tax Treaty Jurisdiction which is wholly owned, either directly or indirectly, by another company also resident in the same tax jurisdiction as the non-listed company and that holding company is listed in that same tax jurisdiction.

Public Notice 9 now extends the scope of the safe harbour rule to the Applicant earning dividend income which is either:

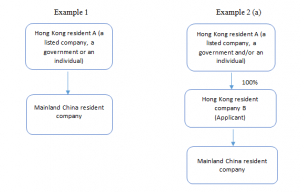

- A listed company, a government or an individual resident in the Tax Treaty Jurisdiction (see Example 1 below); or

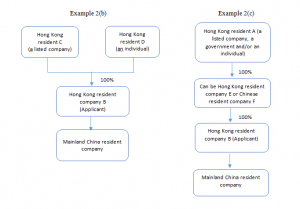

- A a non-listed company resident in the Tax Treaty Jurisdiction which is 100% solely/jointly owned, either directly or indirectly, by a listed company, a government and/or an individual resident in the same tax jurisdiction as the non-listed company [see Example 2(a) and 2(b) below]. The intermediate companies, if any, between the listed company/government/individual and the non-listed company are also required to be resident in the same tax jurisdiction as of that non-listed company or Mainland China [see Example 2(c) below].

- Public Notice 9 also requires the certificates of tax residency of (i) the recipient, (ii) the persons who are qualified as the beneficial owner, and (iii) intermediary shareholders (if any).

Relaxation of the scope for enjoying tax treaty benefits for multi-layer holding structure

Prior to the release of Public Notice 9, an Applicant is potentially not eligible to the tax treaty benefits if it does not fall within the scope of the safe harbour rule under Announcement 30 and it does not qualify as a beneficial owner upon considering the Unfavourable Factors under Circular 601.

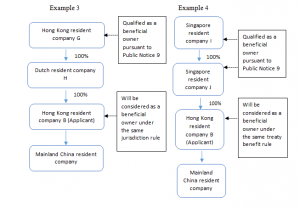

However, Public Notice 9 introduces the so-called “same jurisdiction rule and same treaty benefit rule” applicable to dividend income only, under which even if an Applicant itself does not meet the conditions as a beneficial owner, it will still be qualified as a beneficial owner, provided that (i) the Applicant’s shareholder directly/indirectly holding 100% shares of the Applicant qualifies as a beneficial owner upon being assessed based on the five unfavourable factors under Public Notice 9; and (ii) one of the following scenarios is applied:

(a) Scenarios 1 – Same jurisdiction rule:

The Applicant’s shareholder is resident in the same jurisdiction of the Applicant (see Example 3 below). The intermediate companies between the shareholder and the Applicant, if any, can be resident in any different jurisdictions.

(b) Scenarios 2 – Same treaty benefit rule:

The Applicant’s shareholder is not resident in the same jurisdiction of the Applicant, but the Applicant’s shareholder and all the intermediate shareholder(s), if any, in a multi-layer holding structure are qualified as a beneficial owner under Public Notice 9 and the shareholder and all the intermediate shareholder(s) are entitled to enjoy the same or better tax treaty benefits with respect to the dividends as if they received the dividends directly from Mainland China entities pursuant to the double tax treaties between Mainland China and their respective tax jurisdictions when compared to the benefits granted under the double tax treaty between Mainland China and the Applicant’s tax jurisdiction (see Example 4 below).

Public Notice 9 also requires the certificates of tax residency of (i) the recipient, (ii) the persons who are qualified as the beneficial owner, and (iii) intermediary shareholders (if any).

Conclusion

By releasing Public Notice 9, Chinese tax authorities will look more into the business substance and relevant facts when determining a Mainland China beneficial ownership status. On the other hand, there are certain new conditions under which a company can be qualified as a beneficial owner for enjoying double tax treaty benefits.

Investors who make equity investments into Mainland China entities are therefore recommended to conduct a review on the impacts of Public Notice 9 on their current or intended shareholding and business structures.