Non-Resident Individuals Income Tax Rates in Singapore and Hong Kong

Singapore and Hong Kong are two international cities in the Asia Pacific region which attract a lot of foreigners for investment and work opportunities. One of the concerns these foreigners may have is the individual income tax liabilities on their income earned.

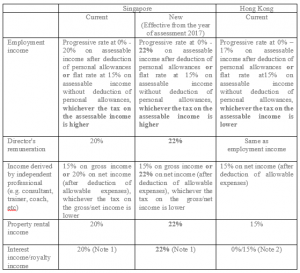

In Hong Kong, the income tax rates applied to non-resident individuals have remained the same since the year of assessment 2008/09. In Singapore, however the Inland Revenue Authority announced on 12 June 2015 that the income tax rates (except certain reduced final withholding tax rates) applied to non-resident individuals will be increased to 22% starting from the year of assessment 2017.

This increment is made for the sake of fairness given the top progressive income tax rate applied to Singaporean resident individuals will also be increased from 20% to 22% effective from the year of assessment 2017 according to the Budget for 2015 introduced in February 2015.

The current and new tax rates applied to non-resident individuals in Singapore as well as the current tax rates applied to non-resident individuals in Hong Kong are summarised as follows:

Notes:

(1) The domestic rate of 20% to 22% is applicable if the conditions for entitlement to the reduced final withholding tax rate on interest income at 15% or royalty income at 10% is not satisfied.

(2) Interest income received by non-resident individuals is generally not subject to tax in Hong Kong.

Following the above, it appears that the individual tax liabilities of non-residents in Hong Kong are generally lower than non-residents in Singapore. Having said that, it is necessary to take into accounts tax deductions and allowances eligible by as well as tax reductions and relief granted to the non-resident individuals, if any, before a final conclusion can be drawn.