Are Virtual Banks a Viable Banking Solution?

With the increasing reliance on financial technology (often shortened to fintech), traditional banks are no longer the only option for opening a bank account. Instead, thanks to the developments in fintech, people now can open business bank account with a virtual bank provider. Currently, Hong Kong has 8 virtual banks and a growing number of fintech providers that provide alternative to traditional banking solutions.

What is a Virtual Bank or Neobank?

A neobank is a based bank that operates solely digitally or via a mobile app. That means that the bank carries out all the tasks that a conventional bank does with the exception of the physical branches.

There are two types of neobanks:

- Companies that have applied for their own banking license and therefore are named as virtual banks.

- Companies that have partnered with a traditional bank to provide those banking services such as fintech providers providing alternative banking solutions. These are generally griped under the name fintech providers.

Neobanks vs Traditional Banks

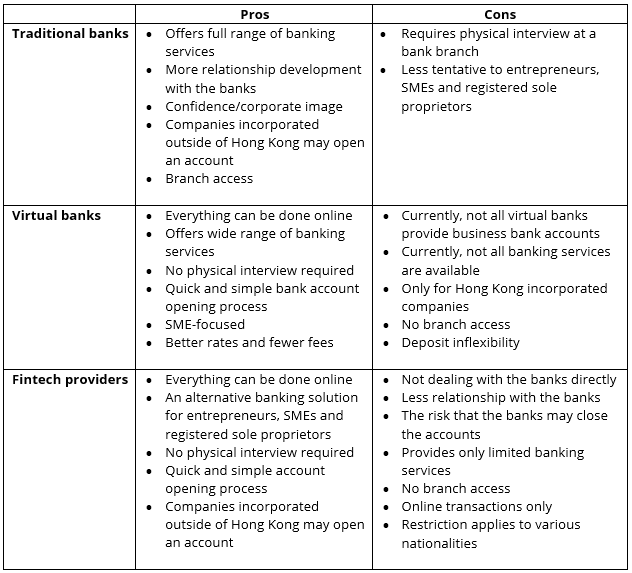

The table below summarises (however this summary list is not exhaustive) the pros and cons of traditional banks, virtual banks and fintech providers when opening a corporate bank account:

Is a Virtual Bank Adequate for your Company?

When considering the right banking solutions, it is also important to consider other factors such as commerciality and practicality, as well as the pros and cons for each of the solutions.

Neobanks are less regulated than traditional banks in many jurisdictions and are not considered actual banks in some legal terms. Furthermore, traditional banks are tightening the regulations regarding the opening and closure of bank accounts.

On the other hand, one needs to be aware that for tax substance purposes, conventional banking accounts may be more suitable than those provided by a virtual bank or fintech provider. Also, a virtual banking account may put limitations on capital transfers, which is especially restrictive when doing business with Mainland China. Additionally, some neobanks have even more strict compliance processes once the account have been opened than traditional banks due to their reliance on the traditional banking system.

Similarly, if you are considering a visa sponsor for employees and /or the business owner, the kind of bank account and the kind of entity that provides the financial service may come under scrutiny. Therefore, these considerations should be discussed with an experienced company incorporation and tax planning adviser during the business registration process.

At HKWJ, we can assist with choosing the right banking solution and opening of the appropriate bank account to fulfil your business needs.