Indirect Transfer of Properties in Mainland China by Non-resident Enterprises

Pursuant to the Enterprise Income Tax (‘EIT’) Law in Mainland China, capital gains derived by non-resident enterprises from the transfer of directly held equity interest in (i) Chinese resident entities or (ii) movable/immovable properties in Mainland China (collectively referred as the ‘Interest in Mainland China’) are generally subject to capital gain tax in Mainland China.

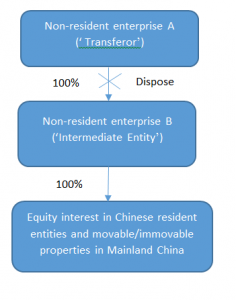

In order to reduce paying EIT on such capital gains, an indirect transfer of the interest in Mainland China may be considered. For example, in such scenario, the Interest in Mainland China is no longer disposed by a non-resident enterprise B (‘Intermediate Entity’), but indirectly by a non-resident enterprise A (‘Transferor’). The indirect transfer arrangement is depicted below:

Public Notice 7

On 6 February 2015, the State Administration of Taxation (the ‘SAT’) of Mainland China issued the Public Notice [2015] No. 7 (the ‘Public Notice 7’), which is an anti-tax avoidance notice in respect of indirect transfers of the Interest in Mainland China by non-resident enterprises.

Pursuant to the Public Notice 7, if a non-resident enterprise indirectly transfers Taxable Property (which is defined in the table below) in Mainland China through the implementation of any arrangements which have no reasonable business purpose other than for the purpose of avoiding EIT in Mainland China, such indirect transfer shall be re-characterised as a direct transfer of Taxable Property by treating the intermediate tax shelter (i.e. the Intermediate Entity) as a transparent entity in accordance with Article 47 of the EIT Law, which is a general anti-tax avoidance provision.

Comparison Between the Circular 698 and the Public Notice 7

Please be aware that prior to the Public Notice 7, tax circular Guoshuihan [2009] No. 698 (the ‘Circular 698’) was issued by the SAT in December 2009, being an anti-tax avoidance circular of a similar nature as that of the Public Notice 7. The Public Notice 7 however extends the scope of Taxable Property covered by the current anti-avoidance provisions and in addition provides for clearer guidelines on the application of the anti-avoidance indirect transfer provisions.

Subsequent to Public Notice 7, the SAT also issued another Public Notice [2017] No. 37 (“Public Notice 37”) regarding the administration of withholding tax. In short, Public Notice 37, among others, provides guidance on the calculation of capital gain of indirect transfer of Interest in Mainland China, suspends certain requirements of registering documents for withholding tax purposes and provides clarification on the buyer’s and the seller’s respective obligations.

We summarise below the main features and reporting obligations relating to indirect transfer of Interest in Mainland China under Public Notices 7 and 37 as compared to those under Circular 698:

| Circular 698 | Public Notice 7 | |

| Taxable property covered | – Equity interest in Chinese resident entities | – Equity interest in Chinese resident entities – Immovable property in Mainland China – Property in an establishment and place of business in Mainland China (collectively referred as the ‘Taxable Property’ ) |

| Guidelines on the determination of reasonable business purpose | No | Yes (Note 1) |

| Safe harbour rule | Yes (Note 2) | Yes (Notes 2 & 3) |

| Reporting obligation | – Certain documents are required to be supplied by the Transferor to the relevant tax authorities in Mainland China if the effective tax rate of the tax jurisdiction in which the Intermediate Entity is located is lower than 12.5% or the tax jurisdiction where the Intermediate Entity is located does not levy income tax on offshore gain (NB: the above requirement has been abolished further to the issuance of the Public Notice 7) – Reporting obligation only rests on the Transferor | – The seller and the buyer of the equity interest in the Intermediate Entity and the Chinese resident entities whose Taxable Property is indirectly transferred can voluntarily report the indirect transfer transaction and submit the relevant documents to the relevant tax authorities in Mainland China – In case that the buyer fails to withhold the tax due, the seller should report and pay the tax according to the instructions given by the Chinese tax authorities. |

| Withholding obligation | Not specifically covered | – Where capital gains from indirect transfers of the Taxable Property are subject to EIT, the entity or the individual, who is obliged to make the payment to the Transferor shall be the withholding agent and be required to withhold the tax. – In case the withholding agent fails to withhold the tax and the Transferor in addition fails to pay the capital gains tax due, the Mainland China tax authorities can pursue the liability against the withholding agent. However, if the withholding agent has voluntarily reported the indirect transfer of the equity and submit the relevant documents to the relevant Mainland China tax authorities as stated above (i.e. under the reporting obligation), the liability borne by the withholding agent may be mitigated or waived. |

Main Areas to Bear in Mind in Indirect Transfer of Properties

1. The factors for determination of the reasonable business purpose include but not limited to the following:

- Whether or not the equity value of the Intermediate Entity is mainly derived, either directly or indirectly, from the Taxable Property in Mainland China;

- Whether or not the assets of the Intermediate Entity consist mainly, either directly or indirectly, out of investments in Mainland China and whether or not the income of the Intermediate Entity is mainly derived, either directly or indirectly, from the source in Mainland China;

- Whether or not the functions and the risks performed/borne by the Intermediate Entity and its subsidiaries, if any, which directly or indirectly hold the Taxable Property in Mainland China are insufficient to substantiate the economic substance;

- The duration of the existence of the shareholders, business mode and relevant organisation structure of the Intermediate Entity;

- Whether or not the income tax payable in the jurisdictions outside Mainland China arising from the indirect transfer of the Taxable Property in Mainland China is lower than that payable in Mainland China if such Taxable Property is transferred directly by the Transferor;

- The alternatives between indirect investment in/indirect transfer of the Taxable Property in Mainland China and direct investment in/direct transfer of the Taxable Property in Mainland China by the Transferor; and

- The circumstances/implications as a result of the application of the relevant tax treaties of Mainland China, if any, on the capital gains from the indirect transfer of the Taxable Property.

The Public Notice 7 has clearly stated that if the above factors1, 2, 3, and 5 are all affirmative, the indirect transfer arrangement shall be deemed as having no reasonable business purpose.

On the other hand, the Public Notice 7 also states that the indirect transfer arrangement shall be deemed to have reasonable business purpose if specific criteria relating to

- The shareholding relationship between the equity transferor and transferee

- The tax burden in Mainland China in respect of the subsequent indirect transfer

- The mode of payment by the transferee to the transferor for the equity transaction are all met.

2. Internal group restructurings which meet the following conditions would be considered as having reasonable commercial purposes:

- Transferor/transferee has 80% or more shareholding relationship (100% threshold will apply if the overseas company has more than 50% of its assets being Chinese real estate).

- The internal restructuring would not result in lesser Mainland China tax liabilities for any indirect transfer of the Mainland China Interest in future

- The consideration paid by transferee is settled by the share capital of transferee or its associates.

3. The indirect transfer shall further also not be deemed to be a direct transfer if one of the following conditions is met:

- The Transferor indirectly transfers the Taxable Property in Mainland China by means of transferring the equity interests in the Intermediate Entity, which is a listed company;

- In the event that the Transferor would have held the Taxable Property in Mainland China directly and transferred this interest subsequently, it would have been entitled to the EIT exemption on the capital gain from the sale of such Taxable Property in Mainland China pursuant to the applicable double tax treaties. This particular safe harbour rule is further discussed below.

Safe Harbour Rule in Connection with the Treaty Exemption

To better understand the application of the safe harbour rule in connection with the treaty exemption, an example is provided.

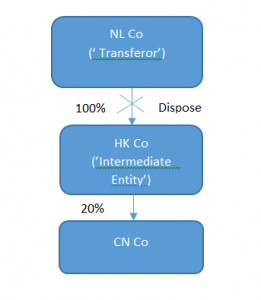

A Dutch tax resident enterprise (‘NL Co’) wholly owns an entity in Hong Kong (‘HK Co’), which holds a 20% of the equity interest in a Chinese resident entity (‘CN Co’), which is depicted below:

Pursuant to the safe harbour rule under the Public Notice 7, in case the indirect transfer is considered as having no reasonable business purpose, such indirect transfer will not be re-characterised as a direct transfer on the basis that NL Co is entitled to the EIT exemption under the articles of the double tax agreement between the Netherlands and Mainland China (‘DTA-NL/CN’).

Note

According to the DTA-NL/CN, gains derived by a resident of a contracting state from the alienation of shares of a company (not being the company the assets of which are comprised, directly or indirectly, mainly of immovable property) which is a resident of the other contracting state are exempted from tax in that other contracting state if the recipient of the gain, at any time during the twelve month period preceding such alienation, had a participation, directly or indirectly, of less than 25% in the capital of that company.

Prior to the issuance of the Public Notice 7, there was no such specific provision.

Following the above example, in case NL Co however holds the equity interest in CN Co of 25% or more, either directly or indirectly, the EIT exemption on the gain from the disposal will not be entitled pursuant to the DTA-NL/CN and therefore the safe harbour rule does not apply.

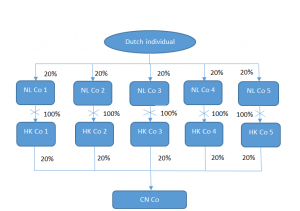

The above new rules however still may result into additional uncertainty. One may wonder for example what would happen in the event a Dutch individual indirectly owns 100% of a Chinese resident entity (i.e. CN Co), but this interest is split over 5 Dutch holding companies with an interest of 20% each. In those circumstances, can the Dutch holding companies still benefit from the safe harbour rule when they sell the equity interest in the Hong Kong companies? Would it make a difference when the so-called Dutch participation exemption can be applied? What if the Dutch individual himself transfers the shares in the 5 Dutch holding companies?

Regarding the last question, the Circular 698 and the Public Notice 7 are applied to indirect transfers of Interest in Mainland China by non-resident enterprises, but not by non-resident individuals.

In addition, before implementing any arrangements, one should consider, amongst others, (i) the cost and benefits involved and (ii) the potential risk of investigation by the Mainland China tax authorities on whether the arrangement is for tax avoidance purpose and invoking the relevant anti-tax avoidance rules.

How can we Assist you with Indirect Transfer of Properties?

It is expected that the Mainland China tax authorities will put more focus on combating tax avoidance arrangements following the launch of the Base Erosion and Profit Shifting project by the Organisation for Economic and Co-operative Development which may give raise to an increased number of capital gains tax dispute.

HKWJ Tax Law are pleased to provide advice and assistance regarding the application of the Circular 698 and the Public Notice 7, including the following:

- Analyse and comment whether there is reasonable business purpose for the indirect transfer arrangement;

- Advise the application of safe harbour rule;

- Review the share/property transfer agreement and other relevant documentation in connection with the indirect transfer; and

- Advise the reporting/withholding obligations arising from the indirect transfer by all the relevant parties involved.