Hong Kong 2016-17 Budget

On 24 February 2016, the Financial Secretary of Hong Kong, Mr. John Tsang Chun-wah, delivered his 9th budget speech for the fiscal year 2016-17. As highlighted by Mr. Tsang at the beginning of his speech, amid the commencement of increment of interest rate by the US Federal Reserve Board, the maintenance of quantitative easing policies and adoption of negative interest rate measures in Europe and Japan as well as the downward pressure of Mainland China economy, it is generally expected that the Hong Kong economic development will be full of challenges and volatility.

Fortunately, Hong Kong has well maintained a healthy public finance with a surplus of HK$30 billion for the fiscal year 2015-16 and an estimated fiscal reserve of HK$860 billion by the end of March 2016. In order to stimulate the economy, support the local enterprises and relieve the financial burden of the citizens, Mr. Tsang proposed a tax and short-term support/relief package in the amount of HK$38.8 billion in his 2016-17 Budget unlike the previous Hong Kong 2015-16 Budget.

Major Support & Relief Measures

The major support and relief measures potentially beneficial to enterprises as well as middle class and upper class individuals include the following support and relief measures are subject to the enactment of the relevant legislation before they become effective:

- Enterprises

-

- Reduction of profits tax for the tax year 2015-16 by 75%, subject to a ceiling of HK$20,000 per case

- Waiver of business/branch registration fees for the fiscal year 2016-17 (i.e. from 1 April 2016 to 31 March 2017). P.S.: The levy of HK$250 is still payable for the fiscal year 2016-17.

- Expansion of the scope of profits tax deduction for capital expenditure on the purchase of the intellectual property (“IP”) rights to the following: layout-design of integrated circuits, plant varieties, and rights in performance

- Waiver of license fees for travel agents, hotels and guesthouses, restaurants, hawkers and operators with restricted food permits for one year

- Enhancing the Small and Medium Enterprise (“SME”) Financing Guarantee Scheme (the “Scheme”) by means of:

- extending the application period for the special concessionary measures (the “measures”) under the Scheme to 28 February 2017

- reducing the annual guarantee fee rate by 10%

- removing the minimum guarantee fee

- Setting up a HK$2 billion Innovation and Technology Venture Fund to co-invest with private venture capital funds on a matching basis in local technology start-ups

- Launching a three-year Pilot Technology Voucher Programme to subsidise the use of technological services and solutions by SMEs at the maximum of HK$200,000 for each eligible SMEB.

- Individuals

-

- Reduction of salaries tax and tax under personal assessment for the tax year 2015-16 by 75%, subject to a ceiling of HK$20,000 per case

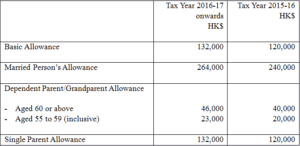

- Increment of tax allowances with effect from the tax year 2016-17:

- Increment of the deduction ceiling of elderly residential care expenses from HK$80,000 to HK$92,000 with effect from the tax year 2016-17

- Both enterprises and individuals

Waiver of government rates charged on the property owners for four quarters during the fiscal year 2016-17, subject to a ceiling of HK$1,000 per quarter for each rateable property

Insights on the Budget

Enterprises

Apart from enjoying the 75% tax reduction capped at HK$20,000 which is same as that in the tax years 2013-14 and 2014-15, all of the enterprises can save the business registration fees of HK$2,000/branch registration fees of HK$73 in the fiscal year 2016-17, which should be welcomed.

It is understood that the government is endeavour to develop Hong Kong as an IP trading hub in the region. Mr. Tsang therefore proposed to allow profits tax deduction for capital expenditure on the purchase of three more IP rights in his 2016-17 Budget as mentioned above. Our view is that in order to further encourage the enterprises to acquire the IP rights for their business development, Hong Kong may consider to grant the taxpayers with an additional tax deduction on the purchase costs of the eligible IP rights (say the allowable deduction being 150% of the purchase costs).

In addition, for the purpose of establishing Hong Kong to be an IP holding and licensing centre, the government may consider to offer tax concession or incentives on the royalty income derived from the licensing of the IP rights.

Moreover, in order to enhance the grant of the IP rights by non-resident enterprises to Hong Kong enterprises for business use by the latter, it is recommended to review the current tax symmetry system governing the taxability of the royalty income earned by non-resident enterprises (i.e. the royalty income earned by non-resident enterprises is subject to Hong Kong profits tax under the prevailing tax laws in case tax deduction is claimed on such royalty payment by the Hong Kong enterprises in Hong Kong).

Individuals

We welcome the tax relief measures suggested in the 2016-17 Budget although no new measures are introduced when compared to prior years. In particular the increment of the basic allowance and married person’s allowance can potentially benefit most of the taxpayers. While the 2015-16 Budget proposed an increment in child allowance, the 2016-17 Budget suggested an increment in dependent parent/grandparent allowance as well as single parent allowance which is pretty fair. It is also believed that the maintenance of 75% tax reduction capped at HK$20,000 for the tax year 2015-16, which is same as the tax year 2014-15 as well as the highest amount since the tax year 2008-09, is acceptable by most taxpayers.

One may be aware that the proposed 75% tax reduction does not apply to property tax. Individuals who have rental income earned from their properties located in Hong Kong may consider to elect for personal assessment (if eligible) so as to enjoy the potential 75% tax reduction as well as other deductions specially allowed under personal assessment.

Looking forward, it is hoped that the government will generously introduce new tax deductions/allowances as well as modify the pre-conditions for the entitlement of the existing tax deductions/allowances due to the social changes. For example, the government may consider to offer tax deductions on medical insurance premium contributions to encourage self-medical protection by the citizens and to release the requirement of the dependent parent/grandparent to be ordinarily resident in Hong Kong in order for the taxpayers to be eligible for the dependent parent/grandparent allowance.

Other Major Tax Related Issues

Mr. Tsang has also highlighted/updated some tax issues in his 2016-17 Budget which are summarised as follows:

(I) Automatic Exchange of Information (“AEOI”)

The government has introduced a bill into the Legislative Council in January 2016 regarding the implementation of the international standard on Automatic Exchange of Financial Account Information in Tax Matters (i.e. the Common Reporting Standard, in short CRS), with the target of bringing the AEOI into effect in 2018 as previously pledged.

(II) Implementation of Base Erosion and Profit Shifting (“BEPS”) Project

Hong Kong is obliged to implement the BEPS project of G20. The government shall conduct the relevant analysis and consultation, and consider the participation in the international framework developed by the Organisation for Economic Co-operation and Development

(III) Promotion of corporate treasury centres in Hong Kong

With a view to attract more multinational and Mainland China enterprises to establish corporate treasury centres in Hong Kong, the government has introduced a bill into the Legislative Council to allow interest expense deductions under profits tax for intra-group financing business and reduce profits tax of qualifying corporate treasury centres by 50 per cent, subject to certain specified conditions.

(IV) Introduction of an open-ended fund company structure

In order to have more choices on the legal forms of investment funds available to fund managers worldwide and enhance the flexibility in establishing and operating funds in Hong Kong so as to develop Hong Kong as an international asset management centre, the government has submitted a bill into the Legislative Council in January 2016 to provide a legal framework and infrastructure for investment fund vehicles by introducing an open-ended fund company structure.

(V) Promotion of aircraft business

For the purpose of speeding up the growth of aviation business in Hong Kong, the government shall examine the use of tax concession to boost aircraft leasing business and explore the business opportunities in aerospace financing.

Contact us now to learn more

[gravityform id=”3″]