Limited Partnership Fund in Hong Kong

A limited partnership fund (LPF) is an onshore fund in Hong Kong in the form of a limited partnership primarily aimed at private funds with private fund managers looking for a cost-effective, onshore LP-GP structuring solution as it facilitates and attracts private equity investment funds to set up and register in Hong Kong.

The LPFs include private equity funds, venture capital funds, buy-out funds, real estate funds, infrastructure and project funds, as well as special situation, distressed asset, credit and hybrid funds.

The LPF regime is governed by the Limited Partnership Fund Ordinance (LPFO), which came into effect in Hong Kong on 31 August 2020. The LPFO replaced the outdated Limited Partnership Ordinance (LPO), which was put in place in 1912. The modern LPFO has been introduced to develop Hong Kong’s position as a premier global asset and wealth management centre.

Benefits of setting up a limited partnership fund in Hong Kong

Traditionally popular jurisdictions for private funds, such as the Cayman Islands, have introduced several reforms to their laws and regulations, posing uncertainties to the fund formation environment.

Much is unclear and there is no market consensus around the economic and practical impact of these reforms, which offers an opportunity for Hong Kong as alternative jurisdiction with the LPF regime.

Hong Kong’s proximity to mainland China and position as a financial centre in the Greater Bay Area (GBA) give Hong Kong the natural advantages to stay competitive in the international market.

This has also led to Hong Kong being an organic part of the renminbi internationalisation drive, as it provides a broad range of offshore renminbi products and hosts the largest renminbi liquidity pool outside of mainland China.

IPOs are a popular exit strategy for many private funds. As Hong Kong leads the world in IPOs, this offers another unique advantage to setting up an LPF in Hong Kong.

A few other prominent key benefits offered by the Hong Kong Limited Partnership Fund include:

- There is no restriction on investment scope

- Flexibility in capital contribution and profit distribution

- No capital duty (0.08%) applied on contributions from limited partners

- No stamp duty for contributions, transfers or withdrawals to/from the LPF

- No capital gains tax

- No public disclosure of limited partners’ information

- Broad contractual freedom for the partners in the LPA

Key requirements and features

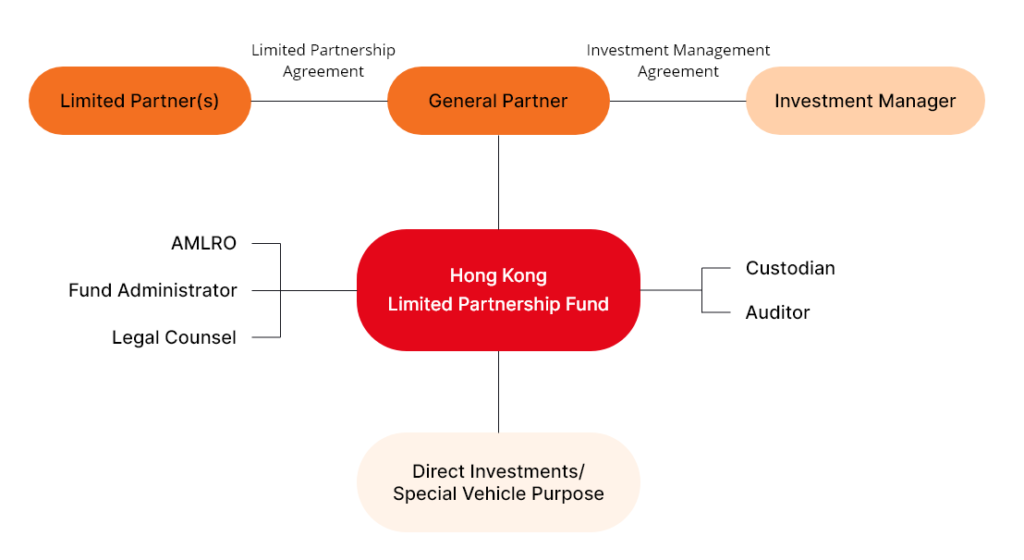

Limited partnership funds are constituted as a limited partnership with a limited partnership agreement (LPA), registered with the Hong Kong Companies Registry. The fund is not required to be authorised by the Securities and Futures Commission (SFC).

Under the LPFO, a fund is defined as an arrangement where:

- The property is managed for business purposes by persons (“operating persons”) on behalf of other persons who do not have day-to-day control over such management (“participating persons”);

- contributions, profits and income are pooled; and

- returns are distributed to one or more operating and participating persons.

Furthermore, to be registered as an LPF, the following conditions must be met:

- There is one General Partner and at least one Limited Partner

- It must have an Investment Manager (IM)

- It must appoint a Responsible Person to carry out anti-money laundering measures (an AML RP)

- It must have a registered office in Hong Kong

- It complies with the naming requirements under the LPFO

- It must appoint an independent auditor

- Partners of the fund may not be only comprised of corporations in the same group of companies (subject to a two-year grace period from the date of registration)

- To not have been set up for an unlawful purpose

- External money must be raised within two years from the registration date

General Partner (GP): the GP may be a natural person (at least 18 years old), a Hong Kong private limited company, a registered non-Hong Kong company, a registered Hong Kong limited partnership, an LPF or a non-Hong Kong limited partnership (with or without legal personality).

Should the GP be another LPF or a non-Hong Kong limited partnership without legal personality, an authorised representative must be appointed (either a Hong Kong resident, Hong Kong company or registered non-Hong Kong company).

The GP has ultimate responsibility for the management and control of the LPF and will be liable for all the debts and obligations of the LPF.

Limited Partner (LP): there must be at least one LP when registering an LPF. An LP is only liable to the amount of their capital contribution to the partnership, but cannot be involved in the management of the LPF.

There are certain activities which will not be regarded as “management” and as such do not compromise the limited liability. These are the so-called safe harbour activities and include:

- Serving on a board or committee of the LPF

- Discussing with, advising or approving the GP or investment manager of the limited partnership

- Calling, requesting, attending or participating in a partners meeting

Investment Manager (IM): an investment manager carries out the day-to-day investment management function of the LPF and must be appointed by the GP. It is allowed for the GP itself to perform the role of investment manager.

The IM must be either a Hong Kong resident, a Hong Kong company or a registered non-Hong Kong company.

An SFC license for the IM may be required if it engages in a regulated activity that falls under the remit of the SFC.

AML requirements: Hong Kong is generally in line with the internationally recognised Recommendations by the Financial Action Task Force and anti-money laundering requirements are similar to other jurisdictions, such as the Cayman Islands.

A Responsible Person to carry out anti-money laundering (AML) and counter-terrorist financing (CTF) functions must be appointed by the GP. This can be a Banking Ordinance authorised institution, licensed corporation, accounting professional or legal professional. If the GP falls within one of these four categories, it may serve as the AML RP.

Besides the appointment of the AML RP, LPFs are required to maintain several records. These comprise a register of partners and investor due diligence documents, such as information obtained during identity verification, files relating to investors’ accounts and business correspondence with investors. These records are not subject to public inspection and may only be reviewed by governmental bodies.

Legal liability: LPFs have no separate legal liability. The GP will have unlimited liability for all debts and obligations of the LPF, unless the GP has no legal personality. In case of the latter, an authorised representative should be appointed.

Auditor appointment and proper custody: a Hong Kong-registered auditor must be appointed by the GP. Additionally, the GP must ensure there are proper custody arrangements for the fund’s assets. Records must be made available for inspection by Hong Kong Government bodies (but not for public inspection) and an annual return must be filed with the Registrar.

Registration and licensing of a limited partnership fund

The proposed GP of an LPF must apply to the Hong Kong Companies Registry (CR) to register the fund. The application pack itself must be submitted by a Hong Kong-registered law firm or solicitor on behalf of the GP. After registration, the LPF should file annual returns and notify the CR if any particulars are changed.

In general, LPFs are not required to be registered and authorised by the SFC, unless the LPF targets retail investors. Furthermore, it is not subject to investment restrictions, disclosure and operational requirements imposed by the SFC. However, should the GP or IM of the LPF carry out regulated activities in Hong Kong, the appropriate SFC licence(s) must be obtained.

The LPFO prescribes the fees for registration, filing annual returns and change notifications, which are all lower than existing fees in the Cayman Islands.

Furthermore, LPFs are required to appoint an investment manager to carry out the daily investment management functions of the fund. The LPF must assess whether there are any SFC-regulated activities carried out in Hong Kong, because in that case the GP or IM of a fund is generally required to obtain a license from the SFC.

License exemptions are available depending on the specific arrangements of the fund and have to be determined on a case-by-case basis.

Migration, onshorisation & re-domiciliation

Qualifying funds registered under the old LPO are provided a streamlined channel to migrate to the LPF regime. The application for the migration is similar to what is required for new LPFs. Migration prevents any identity or continuity disruptions and does not trigger any profits tax and stamp duty implications.

On the other hand, since an amendment under the LPFO in 2021, it is possible to re-domicile an overseas fund in the form of a limited partnership (non-Hong Kong LPF) to a Hong Kong limited partnership fund (Hong Kong LPF).

Dissolution of a limited partnership fund

The limited partnership fund regime offers a straightforward dissolution process compared to the old LPO regime. An important feature is that an LPF may be dissolved in accordance with the LPA.

LPFs can also be dissolved with or without a court order in certain default situations. A notification of dissolution must be filed with the Companies Registry.

A partner in the fund or a creditor can apply for a court-ordered dissolution in prescribed circumstances. Before a fund can be dissolved, tax clearance from the Hong Kong Inland Revenue Department is required.

How HKWJ Tax Law & Partners can help

At HKWJ Tax Law & Partners, within the framework of the HKWJ group, we can help in registering, structuring and setting up your limited partnership fund and creating a detailed limited partnership agreement. We have Hong Kong-registered solicitors who will take care of all the legal aspects and submit an LPF application on your behalf.

Furthermore, HKWJ Group can act as Authorised Representative and/or AML Responsible Person for your LPF. We also can provide corporate services such as annual return filing, tax advisory, and accounting services and auditing to ensure the full compliance of the LPF to Hong Kong laws.