Easy Guide to The Foreign Sourced Income Exemption regime (FSIE) in Hong Kong

Hong Kong proposed a new Foreign Sourced Income Exemption (FSIE) regime in 2022. This new regime has become effective from 1 January 2023, with no grandfathering arrangements.

As seen, the Hong Kong tax system keeps embracing international standards, such as OECD norms regarding the taxation of passive income (i.e. dividends, interests, royalties and capital gains).

This was especially necessary when the European Union placed Hong Kong on the “Grey List of Non-Cooperative Tax Jurisdictions” in October 2021, due to concerns about double non-taxation of certain foreign sourced passive income under the territorial source regime of Hong Kong.

Who falls under the FSIE regime?

Members of Multinational Enterprise Entity (MNE) groups (i.e. MNE entities) carrying on a trade, profession or business in Hong Kong are subject to the new FSIE regime (“covered taxpayer”), unless they can meet the exemption conditions.

This means the FSIE regime does not apply to:

- Standalone local enterprises without offshore operation

- Companies belonging to purely local groups (without overseas constituent entities)

- Individual taxpayers

Additionally, regulated financial entities and MNEs benefitting from existing preferential tax regimes of Hong Kong are generally not affected by the new FSIE regulation, provided that certain conditions can be met.

What does FSIE cover?

The existing territorial source regime will continue to be applied in Hong Kong.

Nevertheless, the following four types of foreign-sourced passive income (“covered income”) received in Hong Kong by a covered taxpayer are deemed to be sourced from Hong Kong under the FSIE regime and liable to Hong Kong Profits Tax at the standard rate of 15%/16.5% or reduced rate of 7.5%/8.25% under the two-tiered profits tax rate system, unless the exemption conditions can be met:

- Dividends

- Interests

- Share disposal gains

- Income from intellectual property (IP), such as royalties

Foreign-sourced passive income will be considered as received in Hong Kong if and when such income is:

- Remitted to, transmitted, or brought into Hong Kong; or

- Used to satisfy any debt incurred in respect of a trade, profession or business carried on in Hong Kong; or

- Used to buy movable property, and the property is brought into Hong Kong.

The FSIE is subject to specific anti-avoidance rules.

Exemption conditions

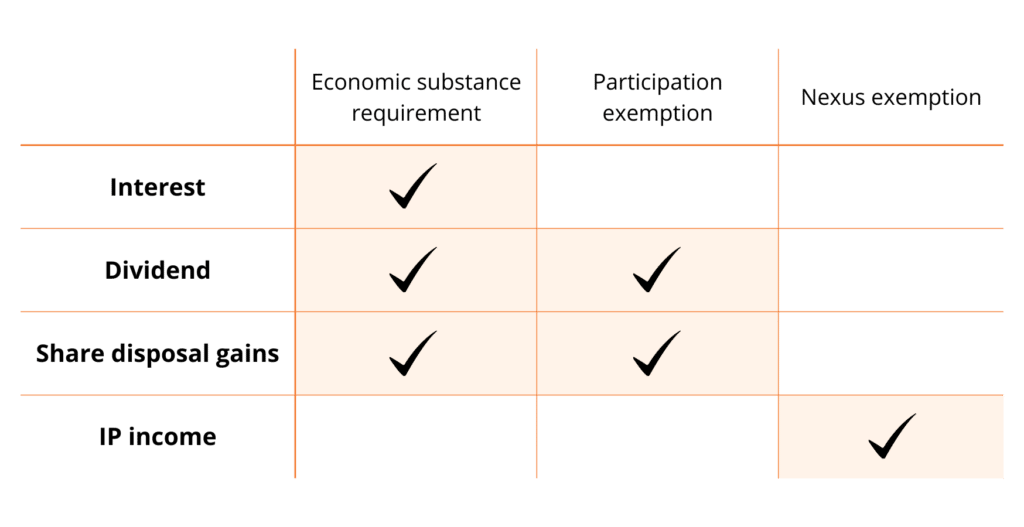

The four types of foreign-sourced passive income could be excluded from Hong Kong Profits Tax under the FSIE regime if the conditions under the economic substance requirement (ESR), participation exemption or nexus exemption can be met, which are summarised as follows:

The economic substance requirement applies to interests, dividends, and share disposal gains, whereas the participation exemption only applies to the latter two.

Regarding foreign-sourced IP income, only the nexus exemption is available.

Economic substance requirement (ESR)

Dividends, interests and share disposal gains (i.e. non-IP income) will not be subject to Hong Kong Profits Tax if the covered taxpayer has enough economic substance in Hong Kong.

Pure equity-holding entities are subject to reduced economic substance requirements. Specifically, they are only required to satisfy every applicable registration and filing requirements in Hong Kong and have adequate HR and premises for conducting the “specified economic activities” (i.e. holding and managing equity participations in other entities) in Hong Kong.

As regards to non-pure equity-holding entities, they are subject to more economic substance requirement in Hong Kong, such as employing adequate number of employees with necessary qualifications as well as incurring adequate amount of operating expenditure for carrying out the specified economic activities (i.e. making necessary strategic decisions in respect of assets acquired, held or disposed as well as managing and bearing the principal risks in respect of such assets) in Hong Kong.

The Inland Revenue Department (“IRD”) does not specify the minimum thresholds for the purpose of determining whether the economic substance requirement is met. Each case will be considered based on its own facts and circumstances.

It is allowed to outsource economic activities to meet the economic substance requirement. Outsourcing can be done through external providers or group entities (such as subsidiaries). In either case, the covered taxpayer must show sufficient supervision of the outsourced activities and maintain proper documentation.

Lastly, it is worth noting that companies engaging in investment activities, such as investing in securities, can also be tax exempt from the FSIE regime if they meet the economic substance requirement.

Participation exemption

Aside from the economic substance requirement, foreign-sourced dividends and share disposal gains (interests not included) can be exempted from Hong Kong Profits Tax under the FSIE regime if the conditions under the participation exemption are met, which are as follows:

- The covered taxpayer is a Hong Kong resident or a non-Hong Kong resident, but with a permanent establishment in Hong Kong; and

- The covered taxpayer has continuously held a minimum of 5% of shares or equity interest in the investee entity concerned for a period of not less than 12 months immediately before the foreign-sourced dividend or share disposal gain accrues

It has to be well noted that the participation exemption is subject to certain anti-abuse rules, such as subject to tax condition, anti-hybrid mismatch rule, and main purpose rule.

Nexus exemption

The nexus approach may exempt companies of intellectual property taxation in offshore-sourced passive income derived from IPs. The exemption is however only applicable to income derived from qualifying IP assets, which are limited to qualifying patents or qualifying copyright subsisting in software. Accordingly, marketing-related IP assets, such as trademarks, are not qualifying IP assets and hence the income earned therefrom is not entitled to tax exemption.

The amount of the tax exempt IP income earned from the qualifying IP assets is subject to a formula, which is with reference to the portion of the amount of qualifying R&D expenditure incurred in the qualifying IP assets to the overall expenditure.

Relevant R&D activities need to be either (1) undertaken in or outside Hong Kong by the covered taxpayer itself, or (2) undertaken in Hong Kong by its related party(s) resident in Hong Kong, or (3) undertaken in or outside Hong Kong by outsourced unrelated party(s).

Advance ruling & the FSIE

In order to (a) know in advance whether the ESR can be met and/or whether the income is subject to Hong Kong profits tax under the FSIE regime and (b) reduce the compliance burden, taxpayers can apply for an advance ruling with the IRD.

An advance ruling is valid for up to five years of assessment. In addition, the ruling is legally binding.

Applications can be made on an individual or group basis, meaning (1) for the MNE entity itself or (2) for itself and other entities of the same MNE group in Hong Kong.

The conditions for a group application are:

- The specified economic activities of the applicant and other MNE entities are outsourced to one entity under a single service agreement;

- The applicant or its representative has written consent of the other MNE entities for a group application (and must be supplied to the Commissioner on request); and

- A copy of the service agreement should be submitted together with the application.

When to apply?

You can apply for an advance ruling at any time. It normally takes about 21 working days for the IRD to process the application.

In case a positive ruling is obtained from the IRD, taxpayers can enjoy the profits tax exemption under the FSIE, which will be great. Otherwise, taxpayers can explore the tax planning possibilities, under the advice of a tax lawyer, such as business restructuring with a view to maintain/obtain the tax efficiencies earlier.

HKWJ Tax Law can help

Does the FSIE regime impact your company’s tax liability on passive income? Should you take any actions, such as strengthening your economic substance in Hong Kong? Will it help to modify your current business and investment structure?

Our experienced tax lawyers at HKWJ Tax Law & Partners are here to answer your questions, provide tailored tax advice and help minimise the impact of the taxation reform.

We offer a range of services, including application for an advance ruling on compliance with the ESRs and/or taxability of the income under the FSIE regime, thorough assessment of the impact of the FSIE regime on your company, and expert recommendations for maintaining tax efficiency. It is always recommended to do a tax health check in advance to know the tax position, minimising the tax risks, and maintaining the company’s financial health.

Trust in our expertise and professionalism to secure your company’s future. Contact us today to schedule a consultation via the form below.